Market Making Service

Solving The Problem

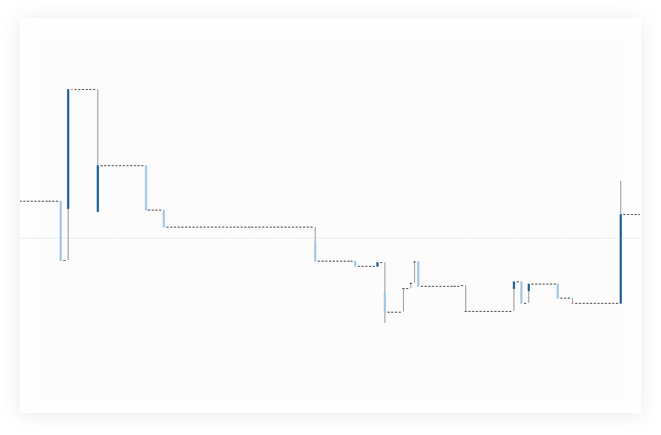

Candles: before

When a trader views the chart of the token on the exchange and views blank candles in the 30m time span, 'the currency is dead' is the first thought that comes to mind. This condition is not good.

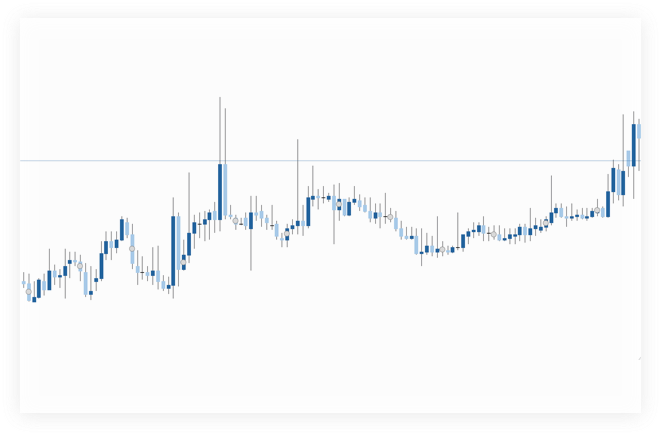

Candles: after

We grant liquidity to your trading pairs. Traders can buy and sell a token or coin instantly without missing a spread. Micro orders are executed to keep your candlesticks in good formation.

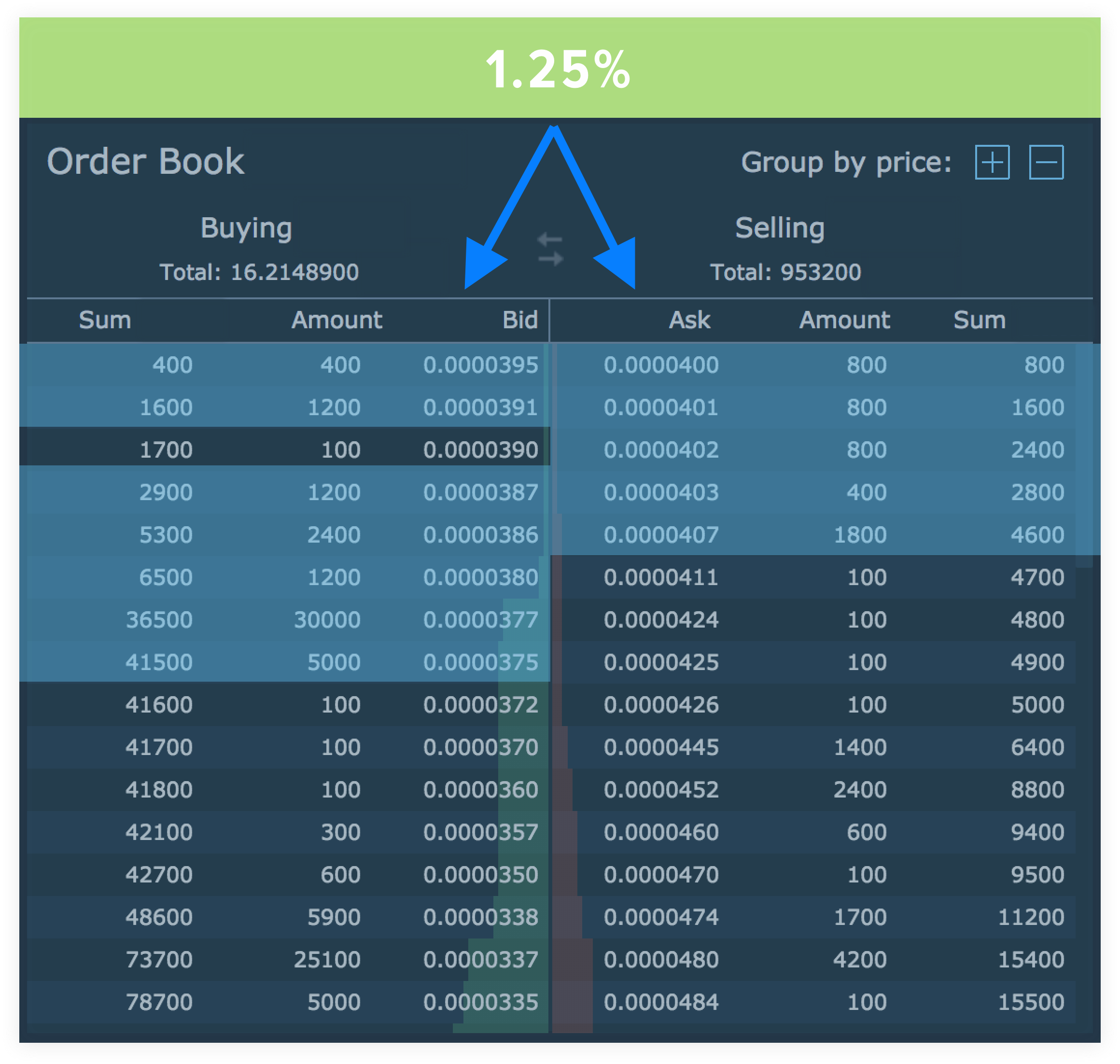

Orderbook Spread

Spread: before

Spreads are the variation in the ask (sell) price and the bid (buy) price of the market. There are mainly two prices provided in a currency pair, the bid, and the ask price. You can see how it works in the chart below.

Spread: after

Closing this spread to less than 2% is a sign of a healthy market. In general, places like CoinGecko and CoinMarketCap only give good health rank scores to markets with spreads under 2%.

What We Do

How Does It Work

More information about how our liquidity pools work can be found here: Liquidity Pools

Prices for the spot markets are determined by a constant spread rate that is set at the time of creating the market making. Usually we try to keep the spread between buy and sell prices at 3% or lower, then the distance for the remaining orders can be anywhere from 2-4% away from the previous orders.

Quantities for each price level are determined using the formula P = sqrt(C/$). Where P is the primary asset total quantity in the pool, C is the constant product of the pool (constant product = Primary Asset Quantity * Secondary Asset Quantity), $ is the price. Using this formula we can determine for any price level how much of the Primary asset the liquidity pool can provide.

Due to the nature of how constant product liquidity pools work, there will always be some liquidity at every price level. Neither the Primary nor the Secondary asset quantities can ever reach zero.

Costs

FAQ

What is Market Making and how does it work in cryptocurrency?

Market Making is a process of providing liquidity to an asset's market to make it attractive to users. The market maker helps keep the spread in the order book of the asset as tight as possible by executing micro orders. Our market making system uses a unique hybrid of automated market making from liquidity pools applied for spot markets. We setup a liquidity pool for each of the spot market pairs and use mathematical equations to determine price points and quantities to place into the spot market orderbooks.

What are the benefits of Market Making for asset developers?

The main benefit of Market Making is to make the market more attractive to users by providing liquidity and keeping the spread in the order book tight. This can help markets grow organically by attracting more buyers and sellers who then provide more liquidity.

What is the spread in cryptocurrency trading and how does it affect the market?

Spread is the difference between the ask (sell) price and the bid (buy) price of the market. A tight spread, typically under 2%, is a sign of a healthy market and attracts more users to the market. Our market making system tries to keep the spread between buy and sell prices at 3% or lower.

How does the Market Making service work at NonKYC?

First, we set up a liquidity pool on our platform for each of the spot market pairs. The amount of liquidity provided into the pool directly reflects in the order book quantity amounts on the spot market. We use mathematical equations to determine price points and quantities to place into the spot market order books. We use a constant spread rate and constant product liquidity pool to ensure there is always some liquidity at every price level.

Is there a cost for using the Market Making service at Crypto Liquidity Providers?

There is no charge for the service, but it is required to deposit the funds necessary to create the liquidity pool for the market making. The amount needed depends on the project and can be discussed with us. Contact us for more information.

Have Questions? Contact our lead developer here:

Telegram @Nonkycadmin

* We have only 1 lead developer (@Nonkycadmin) and he will not DM you first.

Anyone else that sends you a DM with offers are scammers and you should block and report them.