Liquidity Pools

What is a liquidity pool?

A liquidity pool is a crowdsourced pool of cryptocurrencies or tokens locked in the exchange that are used to facilitate trades between the assets. Instead of traditional markets of buyers and sellers, the liquidity pools use automated market maker algorithms (AMM), which allow digital assets to be traded in an automatic manner through the use of liquidity pools. Liquidity pools aim to solve the problem of illiquid markets by incentivizing users themselves to provide crypto liquidity for a share of trading fees. Trading with liquidity pools require no buyer and seller matching. This means users can simply exchange their tokens and assets using liquidity that is provided by users.

What is slippage?

Slippage is the difference between the expected price of a trade and the price at which it is executed. Slippage is most common during periods of higher volatility, and can also occur when a large order is executed but there isn’t enough volume at the selected price to maintain the bid-ask spread. Trades that exceed a 0.5% tolerance in price are automatically rejected to protect the trader.

How does the liquidity pool work?

A crypto liquidity pool must be designed in a way that incentivizes crypto liquidity providers to stake their assets in a pool. That’s why most liquidity providers earn trading fees from the exchanges upon which they pool tokens. When a user supplies a pool with liquidity, the provider is given a portion of any trade fees collected in relation to the percentage of liquidity provided to the pool. The trade fee collected by NonKYC is 0.2%, and this entire fee is distributed to the pool stakers. NonKYC does not collect any fee for itself on liquidity pools unless we are also a liquidity provider. A user who is providing 50% of the liquidity in the pool will receive 50% of the trade fees collected.

A user may remove their current liquidity from the pool at any time, along with any fees that were collected.

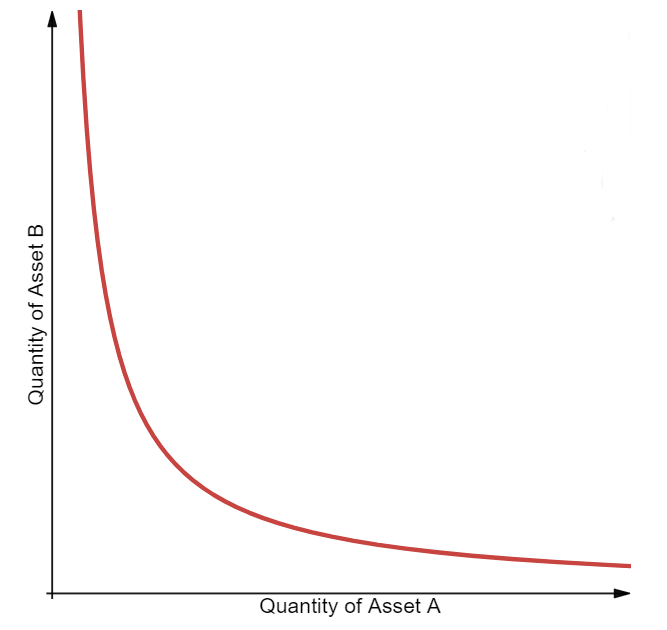

Liquidity pools maintain fair market values for the tokens they hold thanks to the AMM algorithms, which maintain the price of tokens relative to one another within any particular pool. Liquidity pools in different protocols may use algorithms that differ slightly. For example: Uniswap liquidity pools use a constant product formula to maintain price ratios, and many DEX platforms utilize a similar model. This algorithm helps ensure that a pool consistently provides crypto market liquidity by managing the cost and ratio of the corresponding tokens as the demanded quantity increases. NonKYC also uses the contant product formula, which is basically {primaryLiquidity} * {secondaryLiquidity} = {constantProduct}. For an individual liquidity provider, the Constant Product does not change.

For an example, lets assume we have an initial liquidity pool of 100,000 XYZ token (a) and 1,000 ETH (b). The constant product for this would be 100,000,000 (c), giving this asset an initial price of 100 XYZ per ETH. When buys and sells occur, (a) and (b) will change, however (c) will not. Price will increase and decrease based solely on demand and how much liquidity is available in the pool and the value of a ÷ b = price.

What is the difference between NonKYC liquidity pools and DEX pools such as Uniswap and Pancakeswap?

NonKYC is a centralized exchange, which means instead of using an on-chain contract to perform the swaps, we use a backend engine which performs the actions atomicly. Since we are not reliant on a specific blockchain, any asset we have listed on the platform can by used in a liquidity pool, and any user can create a pool pairing of their choice as long as they are providing liquidity. The swaps occur internally and not on-chain, therefore you will not need to pay a blockchain transaction fee when adding/removing liquidity or performing a swap. We do not charge any fees for adding or removing liquidity, and the fee for trades is set at 0.2%. These trade fees are in turn given to the liquidity providers.